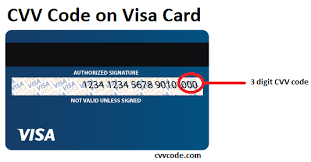

Card Verification Value, CVV or CVV2, is an authentication system established by credit card companies to further

efforts toward reducing fraud for internet transactions.

The card holder is required to enter the CVV2 number in at transaction time to verify that the card is on hand.

Visa & MasterCard

The CVV2 is printed on your Visa card or MasterCard in the signature area on the back of the card. It is the last 3 digits AFTER the credit card number in the signature area of the card.

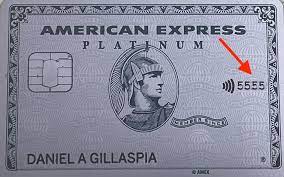

American Express

American Express cards have a 4-digit security code located on the front-right corner of the card.

Your credit card CVV code may not be in the same place on every credit card. If you have an American Express® Card,

you will find the four-digit credit card CVV on the front.

Diners Club CVV

For VISA, MasterCard and Diners Club cards, the three-digit CVV number is printed on the signature panel on the back of the card immediately after the card's account number.

For American Express, the four-digit CVV number is printed on the front of the card above the card account number.

Rupay CVV

Locating the CVV is simple. It is the three-digit number at the back of your debit card.

For certain types of debit cards, it could be a four-digit number printed on the front.

however for Rupay CVV is found on the back side of the card near signature panel as found on Visa/Mastercard.

Discover CVV

Where can I find my CVV online Discover card?

On Discover it® credit cards, the three-digit CVV is on the back of your card at the end of your 16-digit credit card number.

It is sometimes italicized.

JCB CVV

Customers using JCB. The security code is a three-digit number on the back of the credit card.

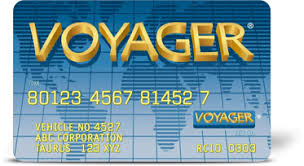

Voyager CVV

Voyager cards have a 4-digit security code located on the front-right corner of the card.

China Union Pay CVV

Turn the card over so that the reverse of the card which holds the signature stip. On that strip, there are 7 number. The first four are usually the same one as on the card.

China-t-union CVV

Turn the card over so that the reverse of the card which holds the signature stip. On that strip, there are 7 number. The first four are usually the same one as on the card.

InterPayment & InstaPayment CVV

In in nutshell

For cards with three-digit CVVs, the CVV number might appear on the back of your card,

typically next to the signature box. For cards with four-digit CVVs, the CVV number may appear on the front of the card.

Maestro CVV

Where can I find the CVV code? The CVV code is a code that helps you use your credit card securely.

It is short for Card Verification Value (or Card Verification Code).

The 3-digit code is written on the back of your ABN AMRO credit card, next to the strip bearing your signature.

Dankort CVV

Dankort Cards

Your card security code for your Dankort is a three-digit number on the back of your card, immediately following your main card number.

MIR CVV

MIR have a 4-digit security code located on the front-right corner of the card.

Please note: Merchant are sometime not allowed to save a CVV2 code in our billing database.

This is why some credit cards cannot be automatically charged.

If you have enough funds on your card, but your auto-payment fails, it is likely because your card company requires the CVV2 for every transaction.

The only solution is to use a different card

or pay manually each time.